Entrepreneurial Finance

REACH OUT TO US

Entrepreneurial Finance

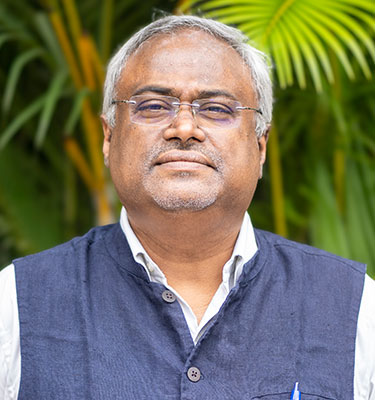

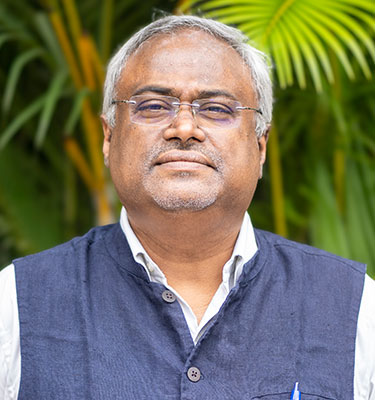

Faculty By

Prof. Umamahesvaram Mandi

Date

17 Dec - 18 Dec, 2022

Category

Entrepreneurship

Program Overview

The Indian venture capital landscape can be at best described to be growing at a rapid pace. Investments in India grew at a pace 3.8 times in 2020 and 1.3 faster than that of China.

The funding levels in Indian venture capital reached $ 38.5 bn in 2021.With a positive microeconomic outlook for India, there is a realistic scenario of deepening Indian venture ecosystem and invigorated investor confidence. The Indian startup and venture scenario is filled with examples of rapid technical advances, increasing consumer confidence and confident investor actions.

Apart from an innovative product or service offering, building a great team, clear plan to scale up and a swifter ability to pivot their business, the entrepreneurs need to develop a clear understanding of different types of investors, deeper understanding of the mechanism of venture-valuations, skills required in negotiation

The Entrepreneurial Finance program is specifically designed to help the participant navigate the realities of funding their venture or start-up enterprise. Participant will gain a practical overview of the skills needed to secure venture capital, and the learning herein is intended to walk them through a business’s evolution from starting up to all the way to a harvesting of the value created. As a clear outcome, it aims that participant enhance their ability to evaluate business opportunities using a framework that encapsulates people, opportunities, context and deal (i.e., POCD)

Course/Program Objectives

The objective of the program is to understand and apply, how to match a business’ financing needs with the most appropriate investor type. Hence the program is intended to provide a solid grounding in company ownership and valuation methods and the competency to use a venture capital valuation tool to value a business throughout its life cycle, and identify appropriate scaling and partial or full exit strategies.

Course/Program Content

- Entrepreneurs and Finance

- Valuation – methodologies, nuances and terms of financing

- Fund raising Process and deal structuring

- The Sources of Finance: Informal sources as in Bootstrap and Crowdfunding and blockchain-based ICOs and the formal sources of funding as in Venture Capitalists and PE funders

- Corporate Governance and role of PE investors in the venture

- Harvesting the investment to create profits through IPOs or a sale of the business.

Program Pedagogy

Pedagogy of the Program consists of Case Studies; interactive analysis Role-play; Project work and presentations and Class Discussions. Activity Based Interactive Learning Approach will form the basis of the learning experience in the program.

Learning Outcomes

- Equip participants with the latest disciplinary and interdisciplinary knowledge with the support of case studies and practical examples in entrepreneurial finance

- Help identify, analyze, and acquire skills to make reasoned and sound business decisions by using models and tools to solve problems effectively in start-up business situations

- Learn how to evaluate entrepreneurial ventures – including high-growth startups using Excel spreadsheet models. Participant will also learn how to discern the tradeoffs of different financing strategies: loan investments, venture capital, angel investing, and crowdfunding

- Emerging trends in venture funding and capital financing and identify the blockchain-based crowdfunding opportunities, where participant will learn how to identify opportunities to disrupt and innovate business models

Faculty Profile

Prof. Umamahesvaram Mandi

PGDM (SPA) – IIM Ahmedabad

B.E. in Agricultural Engineering from College of Agricultural Engineering, Tamil Nadu Agricultural University.

Professor Umamahesvaram Mandi, is an industry professional with 25+ years of professional experience, and has worked in the domains of rural marketing, education and edtech, retail, strategy and investments. In a team, he has invested in 20+ ventures and businesses of retail, education, customer engagement and emerging technologies domains in Bennett, Coleman and Company Ltd. And in RIL, worked on location investment decisions for 600+ petroleum retailing stations that formed part of a retail-network apart from valuing retail assets of a potential target organizations and bidding for potential retailing sites for petroleum retailing. He holds a PGDM (SPA) from IIM, Ahmedabad and is an Agricultural Engineer by training.

His research interests include, Multi-generational entrepreneurship and consumer preferences among Indian agriculturists in adopting weather index insurance to manage risk.

Cancellation

In the unforeseen event of Program Cancellation by the Centre, participants will be refunded the entire amount of Program Fees. If the cancellation is requested by the participant then the Program Fee will be withheld as credit for the next schedule of the same program or an alternative program that the candidate opts for.

Duration: 2 Days

Location: FLAME University

Faculty: Prof. Umamahesvaram Mandi

Categories: Entrepreneurship

Fees: ₹ 35,000/-